Study – “1 YEAR of COVID-19 pandemic: The impact on Romanian companies”

The research report “1 YEAR of the COVID-19 pandemic. The impact on Romanian companies” was published. The study was carried out by a team from the “Alexandru Ioan Cuza” University of Iași, the Iași Chamber of Commerce and Industry, and BDO Romania among Romanian companies in the business network of the partners who conducted the study.

The purpose of the research, carried out during March this year, was to observe the evolution of companies during the first year of the COVID-19 pandemic (February 2020 - February 2021), as well as to have a measure of the companies' perspective for the calendar year 2021.

Data were collected online through questionnaires and interviews from decision-makers in companies (owners, directors, administrators, or branch managers), through 81 interviews and 276 questionnaires, from 29 counties of the country and Bucharest, operating in 18 economic fields.

Context

In Romania, the epidemic of COVID 19 started in February 2020 and the state of emergency due to the epidemic was instituted on March 16, 2020 and lasted until May 15, 2020.

To reduce the rate of spread of infections, throughout 2020 and until now, in 2021, various restrictions have been imposed on the movement of people and the conduct of economic activities, which has affected the activity of many businesses.

February 2021 marks one year since the beginning of the epidemic in Romania, and March 2021 marks one year since the beginning of restrictive anti-pandemic measures.

Of the 276 companies that answered the online questionnaire, 35% are micro-enterprises with between 1-9 employees, 28% are small enterprises with between 10-49 employees, 21% medium-sized enterprises (50-249 employees), and 17% large enterprises with over 250 employees.

Crisis, but not for all companies

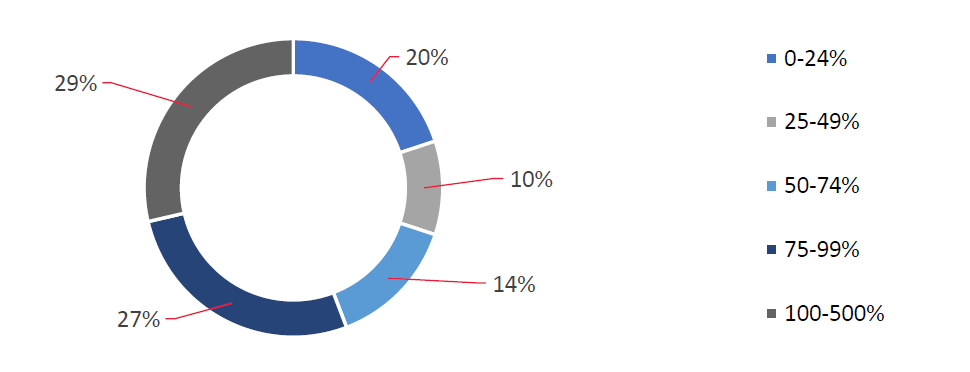

Almost 1 in 3 companies participating in the study registered an increase in turnover in February 2021 compared to February 2020, while the same proportion registered a decrease of more than 50% in turnover. At the same time, for the whole year 2020, 50% of the companies registered increases in turnover compared to the previous year.

Evolution of losses and gains

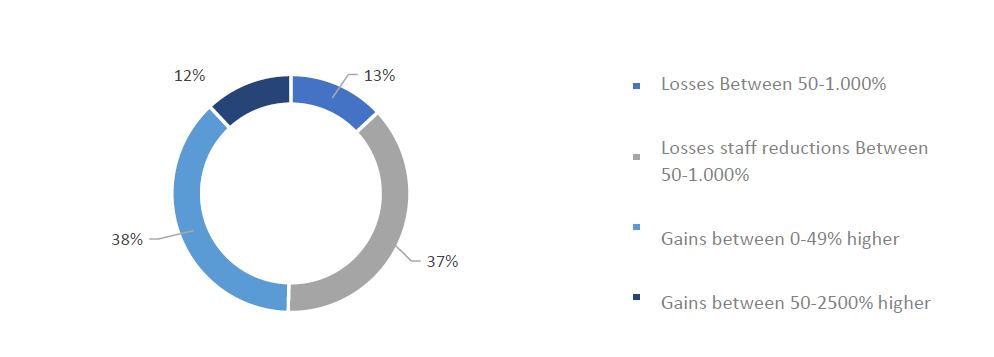

50% of the companies state that they registered losses, 50% that they registered gains. Only 13% of the responding companies stated that they lost more than the equivalent of 50% of the annual turnover in 2019, 12% state that they made higher gains than the equivalent of 50% of the turnover in 2019, some going up to earnings equivalent to 25 years of turnover. staff reductions

Workforce

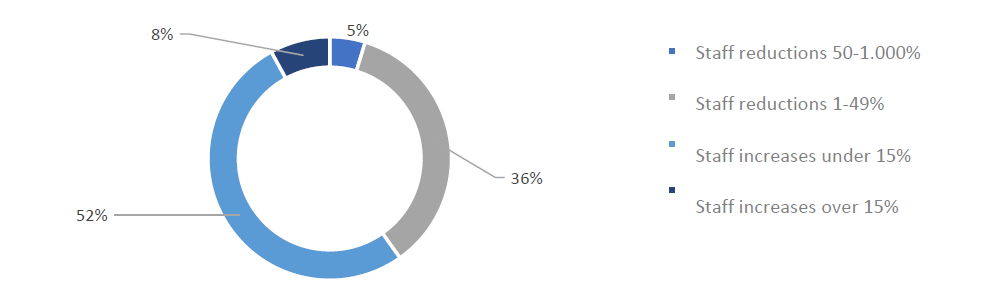

Most companies (60%) recorded staff increases. 68% of the responding companies stated that they did not send any employees in technical unemployment during this period, 11% sent at most 24% of employees in technical unemployment. All employees work at the company's headquarters.

Work-From-Home

Between February 2020 and February 2021, 28% of companies said that no employee had worked in work-from-home in the last year. In 35% of the companies, a maximum of a quarter of the employees worked from home and in 23% of the companies, more than three-quarters of the employees sometimes worked from home.

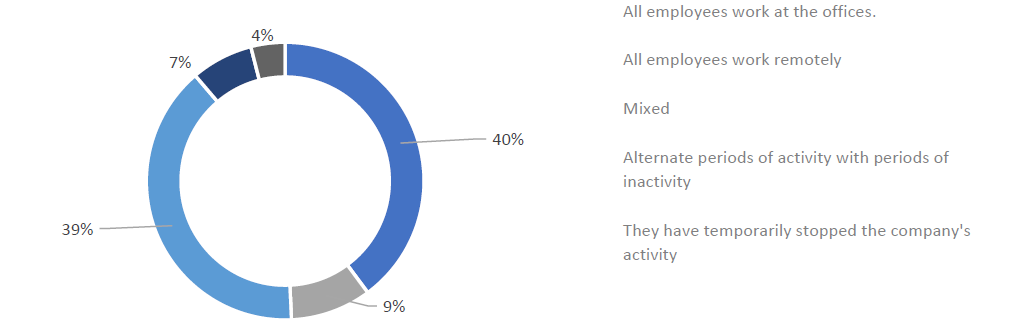

Currently, 40% of the responding companies work with all employees at the headquarters, 39% decided to work mixed, both at the company's headquarters and online, 9% have completely moved the activity to the online environment. Intending to return to normal after the pandemic, 50% of companies say that no employee wants to introduce a combined office-online work schedule while 21% of companies say that between 75% -100% of their employees would like such a program.

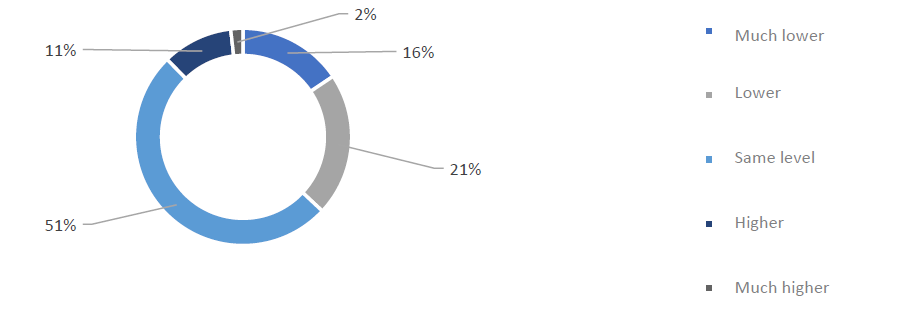

Productivity

51% of companies say that the productivity of employees who worked online, from home, was similar to that of an employee at headquarters. 21% say it was lower and 16% of companies say online productivity was much lower.

Business functions affected by the pandemic

The most frequently mentioned impairments of business functions were at the level of sales activity, associated with the decrease in demand (59%). Next were mentioned human resources problems (33%) due to unavailability of employees and supply problems caused mainly by delayed imports (28%).

Maintaining competitiveness

The most common measures to maintain competitiveness were:

- capitalizing on current markets (73%)

- new channels of communication with customers (65%)

- attracting new customers (62%)

- and introducing new products and services (62%)

The most mentioned business opportunities identified in the last year are those in the online environment, then the emergence of new markets and products for specific needs due to the pandemic with COVID 19.

Digitization

The companies implemented significant measures on 8 of the 9 business digitization directions included in the questionnaire. The most common measures regarding the digitalization of the business were:

- digitalization of the relationship with partners (72%)

- with public institutions (69%)

- online work solutions between employees (71%)

- ordering systems (67%)

- contracting and online payments. (63%)

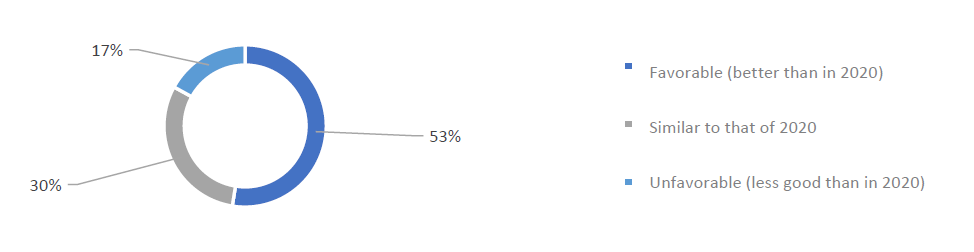

Forecasts of more favorable business evolution in 2021

53% of companies state that they expect a more favorable business evolution in 2021 than in 2020, and 17% that they expect a less favorable evolution. Regarding employees, only 13% of companies expect a decrease in the number of employees this year, the rest of the companies estimating that the number of employees will be maintained or even increased (35% of respondents).

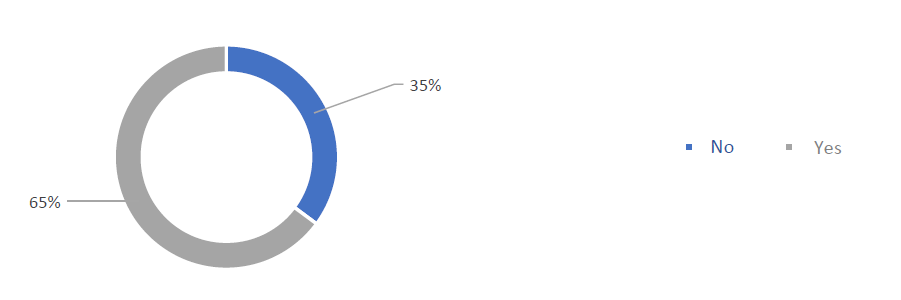

In 2021, most companies see changes in the business model

About 2/3 of the companies intend to make changes to the business model. In the first place, among the expected changes of the business model in 2021, are the changes at the HR level, then those of online business development and digitalization, diversification of products/services, and making new investments.

“We participated in this research, with the idea of enriching our perspective about what happened with Romanian companies during the pandemic, but especially for capture the state of mind among what we consider an important part of the business ecosystem in Romania. As consultants, we want to have a more accurate image, based on data, of the evolution of the business environment. This is the only way we can meet our customers’ needs with concrete and efficient solutions.” said Dan Schipor, BDO Partner and Management Consultant.

The complete results of the study can be consulted online on the websites of the partner entities involved in its realization: www.uaic.ro, www.cciasi.ro, www.bdo.ro/rethink

Dan Schipor, CMC©